Is there a bigger role for satellite in the UK broadband market?

Satellite broadband hasn’t really taken off in the UK in the way that we might have expected it would 10-15 years ago. There are many reasons for this, both technical (latency issues affecting video calling and gaming applications and the potential for weather related outages) and economic (expensive terminal equipment and relatively high ongoing data costs).

Its role has therefore traditionally been limited to providing broadband access where it isn’t cost effective to use other technologies – generally to very remote or rural areas, resulting in a situation that has seen satellite broadband penetration rates averaging 0.2 subscribers per 100 inhabitants as of December 2015 (OECD Report on the Evolving Role of Satellite Networks in Rural and Remote Broadband Access).

This recently published OECD report investigates how new innovations coming out of the satellite industry may see a changing role for the technology in broadband delivery and identifies three different roles for satellite systems:

- Delivering broadband to remote/ isolated areas

- ‘Middle mile’ solution connecting mobile and fixed wireless local access networks to core networks

- Market expansion using LEO satellites to lower density areas next to urban ones (cost becomes more viable where a fiber backbone is already in place).

The OECD also describes three key developments in the deployment of satellite broadband systems.

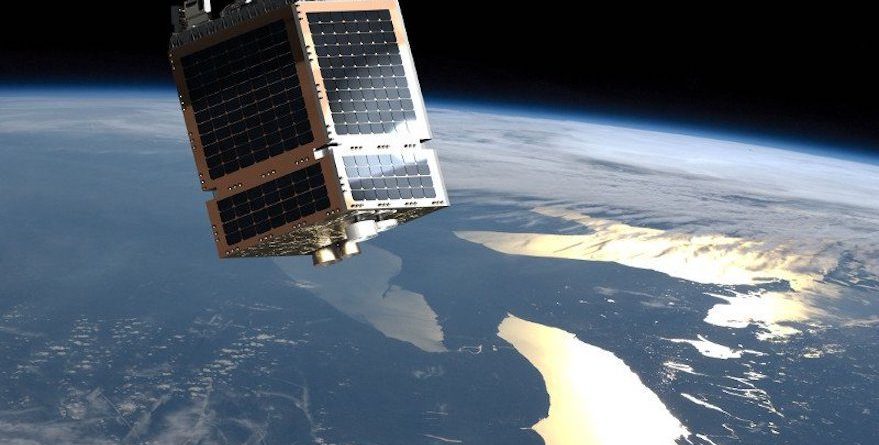

LEO and MEO satellite systems

Currently, satellite broadband services are supplied to the UK using geostationary satellites (GEO) with download speeds of up to 20Mbps on offer. The 2016 Ofcom Connected Nations Report expects that from 2020 superfast speeds and better overall performance will be made available.

The OECD report notes that low and medium earth orbit (LEO and MEO) are increasingly being proposed or deployed (notably the International Space Station which operates in LEO), and that what is lost in scale effects – GEO satellite systems have a much larger coverage area – is made up for in potential cost savings in deployment, reduction in transmission power required and much lower latency. Several companies say that they will deliver Internet access to customers in remote or underserved regions, with some systems even being able to deploy to regions currently beyond the reach of GEO satellites (eg OneWeb).

New Launch Technologies

Reusable rocket technology has the potential to lower launch costs significantly, as does the decreasing mass of the individual satellites, allowing more than one satellite to be launched on the same vehicle.

Next Generation High-Throughput Satellite (HTS) GEO Systems

Defined as GEO systems that instead of covering the surface area with a few wide beams, use more efficient multiple spot beams. These permit a higher rate of data transfer resulting in less expensive end user terminals and reuse frequencies therefore increasing bandwidth.

Any USO solution for the UK will undoubtedly feature satellite, with the BT proposal projecting that “the number of premises that will only have satellite as an option expected to be 0.3% by the end of 2022???. The UK’s Better Broadband subsidy scheme’s satellite offer includes, in most cases, a free satellite dish and installation. Indeed, the results of BDUK Market Test Pilots in 2016 highlighted the advantage of the technology, especially regarding speed and cost effectiveness.

Whereas once satellite might have been written off as an option, the new innovations and developments gathering apace in the sector means that its potential is instead now firmly one to watch.