Consumers’ purchasing choices are driven by quality of experience, choice and transparency of traffic management, reports BEREC

The Body of European Regulators for Electronic Communications (BEREC), have published and adopted a timely report on net neutrality and which traffic management policies influence consumer’s purchasing decisions. The headline finding is that consumers unsurprisingly tend to favour packages that align with Open Internet principles*and that as long as “there is transparency, and consumers are able easily to switch provider, such services seem likely to predominate???. This supports the BSG’s view, backed by the UK Government and Ofcom, that transparency and effective competition are the best guarantors of the Open Internet.

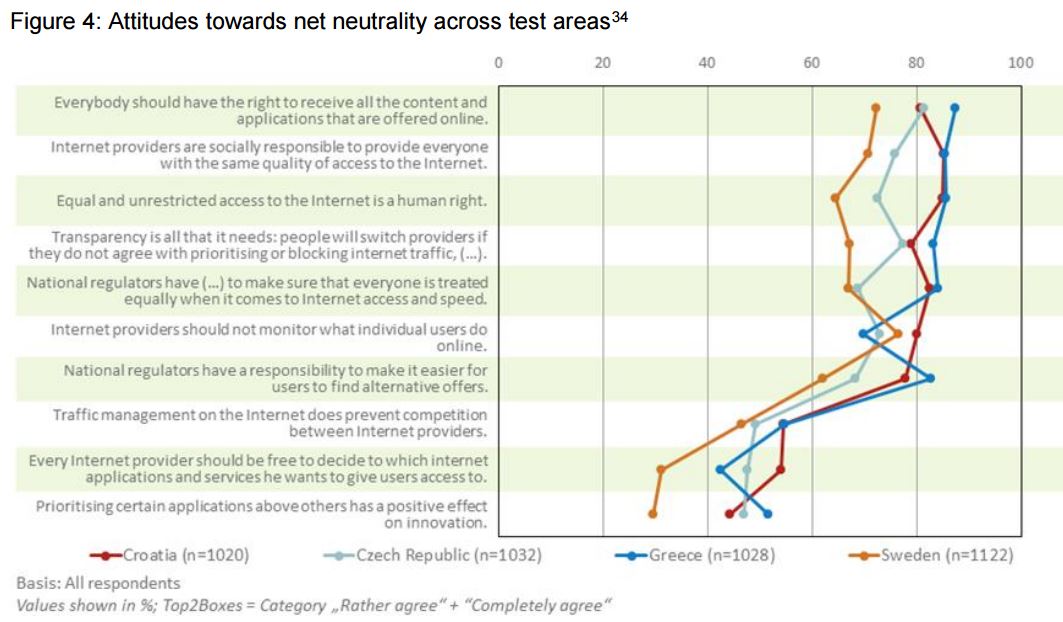

The report, underpinned by work carried out by PWC, WIK-Consult, YouGov and Deloitte, brings together desk research with consumer research carried out in Croatia, Czech Republic, Greece and Sweden to gain an understanding on how consumers value net neutrality. The consumer research makes clear that customers care little for the technicalities of data transport but do have a vested and keen interest into their own quality of experience. As can be seen below, general attitudes towards net neutrality are generally well aligned across the four countries.

The primary drivers of consumer behaviour and choice were price, data caps and access to the open internet – although the economic value between restricted and unrestricted services was smaller across different applications, with video content scoring most highly. A significant proportion indicated that they would consider switching their Internet Service Provider (ISP) should they introduce more restrictive traffic management practices, with “at least half [of those contacted] have already switched [for a variety of reasons] in all four test countries.???

Interestingly, in the focus groups that underpinned the research, users were split into two groups and asked to choose between hypothetical internet access products. Despite one group being given an information briefing, the answers of each group were extremely similar. The report identifies a possible reason in that each product contained a brief “effects based explanation of the end-users’ experience of certain applications, e.g. “slowed-down video streaming??? or “prioritised VoIP???. This is important when it comes to ensuring that consumers are able to make an informed choice rather than being presented with overly technical information.

Whilst the report finds that ISPs are currently incentivised to offer products that at least predominantly offer open internet access, they did state that there were situations where these incentives may change – ie offering a wall garden approach at a certain price point. They also raised the issue of zero rating and specialised services as practices worth monitoring, whilst noting that the latter has the potential to be beneficial to consumers.

The report is an important, evidence based, contribution to the open internet debate at a time when discussions on the Connected Continent Regulation remain in trialogue at the European level. We will continue to be involved in this topic and look forward to seeing how we can incorporate some of the lessons in the report into the UK’s approach.

*Described in the UK’s Open Internet Code as being guided by three principles: users should be able to access all legal content, there should be no discrimination against content providers on the basis of commercial rivalry; and traffic management policies should be clear and transparent.